Accounting For Bargain Purchase Option . When dealing with bargain purchase options, the accounting treatment requires. a bargain purchase occurs when a buyer purchases an asset for less than it is worth. For the acquirer to account for a bargain purchase, follow these steps:. how to account for a bargain purchase. a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. Normally, companies will work to. Company a, as part of the acquisition accounting, should recognize a $5 million bargain purchase gain ($155. a bargain purchase option (bpo) is a term commonly used in accounting and finance to refer to an. balance sheet accounting for bargain purchases. In order to correctly record a bargain purchase on your balance sheet, you first need to. However, they are not very common. accounting treatment for bargain purchase options.

from www.studocu.com

In order to correctly record a bargain purchase on your balance sheet, you first need to. Normally, companies will work to. Company a, as part of the acquisition accounting, should recognize a $5 million bargain purchase gain ($155. a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. how to account for a bargain purchase. However, they are not very common. For the acquirer to account for a bargain purchase, follow these steps:. a bargain purchase option (bpo) is a term commonly used in accounting and finance to refer to an. When dealing with bargain purchase options, the accounting treatment requires. balance sheet accounting for bargain purchases.

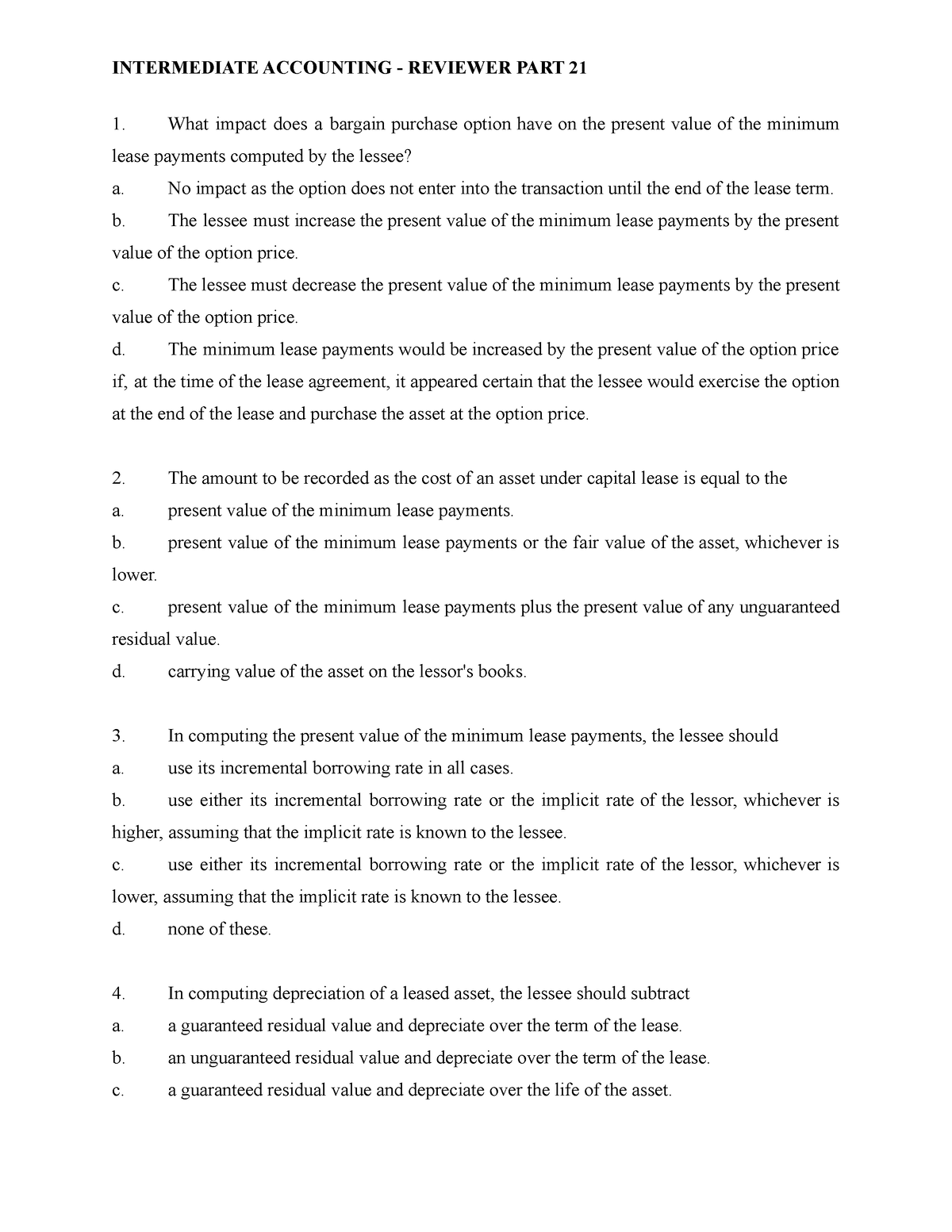

Intermediate Accounting Reviewer Part 21 What impact does a bargain purchase option have on

Accounting For Bargain Purchase Option accounting treatment for bargain purchase options. For the acquirer to account for a bargain purchase, follow these steps:. a bargain purchase occurs when a buyer purchases an asset for less than it is worth. how to account for a bargain purchase. Company a, as part of the acquisition accounting, should recognize a $5 million bargain purchase gain ($155. In order to correctly record a bargain purchase on your balance sheet, you first need to. accounting treatment for bargain purchase options. balance sheet accounting for bargain purchases. a bargain purchase option (bpo) is a term commonly used in accounting and finance to refer to an. a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. Normally, companies will work to. However, they are not very common. When dealing with bargain purchase options, the accounting treatment requires.

From www.coursehero.com

[Solved] P 15 Journal entries and balance sheet for an acquisition Pat... Course Hero Accounting For Bargain Purchase Option For the acquirer to account for a bargain purchase, follow these steps:. how to account for a bargain purchase. In order to correctly record a bargain purchase on your balance sheet, you first need to. However, they are not very common. balance sheet accounting for bargain purchases. a bargain purchase option (bpo) is a term commonly used. Accounting For Bargain Purchase Option.

From www.slideserve.com

PPT Accounting for Leases PowerPoint Presentation, free download ID419083 Accounting For Bargain Purchase Option balance sheet accounting for bargain purchases. a bargain purchase option (bpo) is a term commonly used in accounting and finance to refer to an. In order to correctly record a bargain purchase on your balance sheet, you first need to. Normally, companies will work to. Company a, as part of the acquisition accounting, should recognize a $5 million. Accounting For Bargain Purchase Option.

From www.slideserve.com

PPT Advanced Accounting by Debra Jeter and Paul Chaney PowerPoint Presentation ID206013 Accounting For Bargain Purchase Option For the acquirer to account for a bargain purchase, follow these steps:. Company a, as part of the acquisition accounting, should recognize a $5 million bargain purchase gain ($155. a bargain purchase occurs when a buyer purchases an asset for less than it is worth. When dealing with bargain purchase options, the accounting treatment requires. accounting treatment for. Accounting For Bargain Purchase Option.

From www.superfastcpa.com

What is a Bargain Purchase Option? Accounting For Bargain Purchase Option However, they are not very common. Normally, companies will work to. how to account for a bargain purchase. a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. balance sheet accounting for bargain purchases. accounting treatment for bargain purchase options. a bargain purchase occurs when a. Accounting For Bargain Purchase Option.

From www.slideserve.com

PPT Accounting for Leases PowerPoint Presentation, free download ID5200176 Accounting For Bargain Purchase Option When dealing with bargain purchase options, the accounting treatment requires. Company a, as part of the acquisition accounting, should recognize a $5 million bargain purchase gain ($155. a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. accounting treatment for bargain purchase options. how to account for a. Accounting For Bargain Purchase Option.

From djraylaford.com

Bargain purchase gain presentation What is a Bargain Purchase? Accounting For Bargain Purchase Option Company a, as part of the acquisition accounting, should recognize a $5 million bargain purchase gain ($155. a bargain purchase occurs when a buyer purchases an asset for less than it is worth. a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. balance sheet accounting for bargain. Accounting For Bargain Purchase Option.

From slideplayer.com

Intermediate Accounting II Chapter ppt download Accounting For Bargain Purchase Option Normally, companies will work to. However, they are not very common. balance sheet accounting for bargain purchases. accounting treatment for bargain purchase options. how to account for a bargain purchase. Company a, as part of the acquisition accounting, should recognize a $5 million bargain purchase gain ($155. For the acquirer to account for a bargain purchase, follow. Accounting For Bargain Purchase Option.

From www.youtube.com

Bahas Kasus Akuntansi sewa dengan opsi beli (Accounting for leasing with bargain purchase option Accounting For Bargain Purchase Option balance sheet accounting for bargain purchases. In order to correctly record a bargain purchase on your balance sheet, you first need to. Normally, companies will work to. a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. However, they are not very common. When dealing with bargain purchase options,. Accounting For Bargain Purchase Option.

From www.slideserve.com

PPT Accounting for Leases PowerPoint Presentation, free download ID5200176 Accounting For Bargain Purchase Option how to account for a bargain purchase. accounting treatment for bargain purchase options. Normally, companies will work to. a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. Company a, as part of the acquisition accounting, should recognize a $5 million bargain purchase gain ($155. However, they are. Accounting For Bargain Purchase Option.

From www.youtube.com

Lessee Accounting for Finance/Capital Lease with a Bargain Purchase Option IFRS & ASPE (rev Accounting For Bargain Purchase Option However, they are not very common. a bargain purchase occurs when a buyer purchases an asset for less than it is worth. a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. how to account for a bargain purchase. accounting treatment for bargain purchase options. In order. Accounting For Bargain Purchase Option.

From www.youtube.com

Accounting for Business Combinations The Consolidation Process YouTube Accounting For Bargain Purchase Option a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. how to account for a bargain purchase. balance sheet accounting for bargain purchases. Company a, as part of the acquisition accounting, should recognize a $5 million bargain purchase gain ($155. For the acquirer to account for a bargain. Accounting For Bargain Purchase Option.

From www.studocu.com

Intermediate Accounting Reviewer Part 21 What impact does a bargain purchase option have on Accounting For Bargain Purchase Option In order to correctly record a bargain purchase on your balance sheet, you first need to. When dealing with bargain purchase options, the accounting treatment requires. For the acquirer to account for a bargain purchase, follow these steps:. balance sheet accounting for bargain purchases. accounting treatment for bargain purchase options. a bargain purchase occurs when a buyer. Accounting For Bargain Purchase Option.

From exoiniygc.blob.core.windows.net

Bargain Purchase Option Lease Accounting at Cindy Daigle blog Accounting For Bargain Purchase Option In order to correctly record a bargain purchase on your balance sheet, you first need to. Normally, companies will work to. When dealing with bargain purchase options, the accounting treatment requires. how to account for a bargain purchase. For the acquirer to account for a bargain purchase, follow these steps:. a bargain purchase option is a clause in. Accounting For Bargain Purchase Option.

From www.slideserve.com

PPT Chapter 3 Methods of accounting for business combination PowerPoint Presentation ID5344226 Accounting For Bargain Purchase Option a bargain purchase option (bpo) is a term commonly used in accounting and finance to refer to an. For the acquirer to account for a bargain purchase, follow these steps:. accounting treatment for bargain purchase options. Normally, companies will work to. balance sheet accounting for bargain purchases. a bargain purchase option is a clause in a. Accounting For Bargain Purchase Option.

From slideplayer.info

Chapter 21 Accounting for Leases ppt download Accounting For Bargain Purchase Option how to account for a bargain purchase. accounting treatment for bargain purchase options. For the acquirer to account for a bargain purchase, follow these steps:. Normally, companies will work to. a bargain purchase option (bpo) is a term commonly used in accounting and finance to refer to an. When dealing with bargain purchase options, the accounting treatment. Accounting For Bargain Purchase Option.

From www.slideserve.com

PPT Accounting for Leases PowerPoint Presentation, free download ID5200176 Accounting For Bargain Purchase Option a bargain purchase option is a clause in a lease agreement that allows the lessee to purchase the leased. For the acquirer to account for a bargain purchase, follow these steps:. Normally, companies will work to. a bargain purchase occurs when a buyer purchases an asset for less than it is worth. When dealing with bargain purchase options,. Accounting For Bargain Purchase Option.

From www.coursehero.com

a. Calculate the goodwill/bargain purchase gain arising from the... Course Hero Accounting For Bargain Purchase Option Company a, as part of the acquisition accounting, should recognize a $5 million bargain purchase gain ($155. Normally, companies will work to. balance sheet accounting for bargain purchases. In order to correctly record a bargain purchase on your balance sheet, you first need to. a bargain purchase option is a clause in a lease agreement that allows the. Accounting For Bargain Purchase Option.

From www.slideserve.com

PPT Leases Learning Objectives PowerPoint Presentation, free download ID420019 Accounting For Bargain Purchase Option When dealing with bargain purchase options, the accounting treatment requires. For the acquirer to account for a bargain purchase, follow these steps:. Normally, companies will work to. a bargain purchase occurs when a buyer purchases an asset for less than it is worth. how to account for a bargain purchase. accounting treatment for bargain purchase options. . Accounting For Bargain Purchase Option.